![Tire Market Size, Share and Analysis Report|Forecast [2025-2034]](/uploads/allimg/20251027/1-25102GZ545c8.webp)

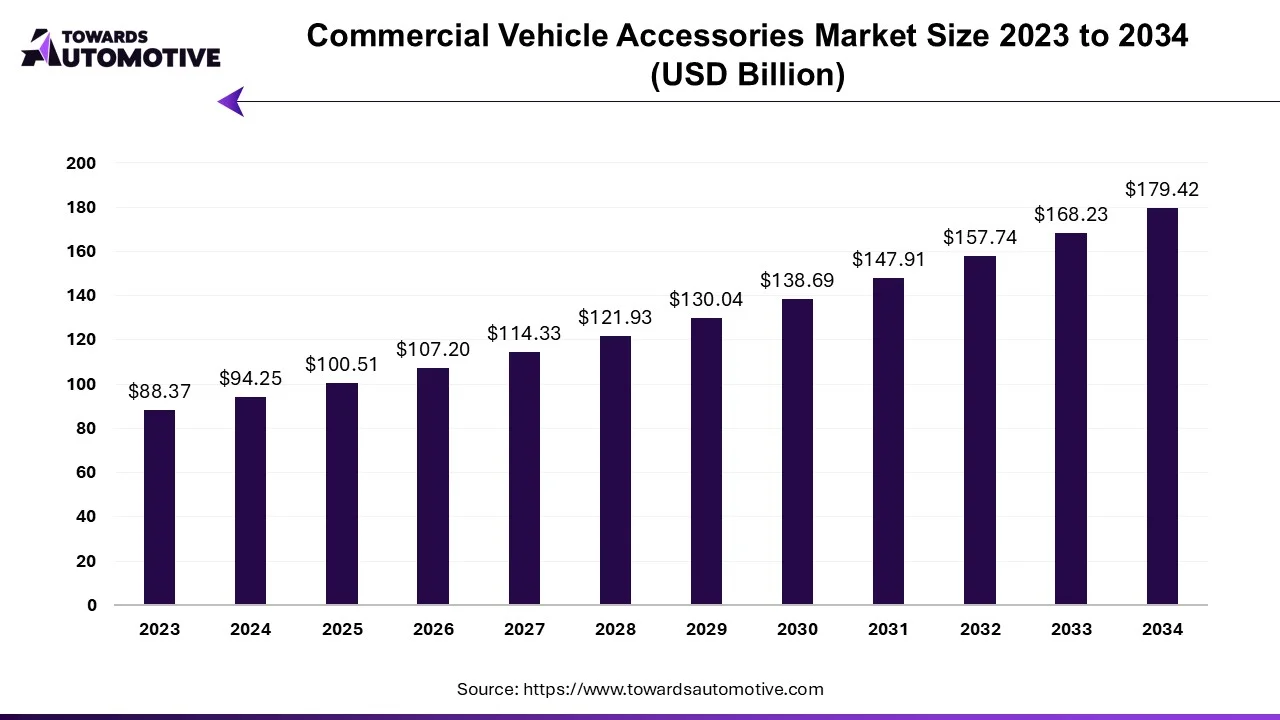

According to a recently published industry study, the global commercial vehicle accessories market is expected to grow from approximately US $100.51 billion in 2025 to about US $179.42 billion by 2034, representing a compound annual growth rate (CAGR) of roughly 6.65%. GlobeNewswire

This significant expansion in the accessories segment offers a valuable window of opportunity for suppliers of heavy-truck tyres (TBR – Truck & Bus Radial) to elevate their positioning from commodity components to strategic value partners in truck fleet operations.

Market drivers and relevance to truck tyres

Several key forces are driving this market expansion — and they all intersect strongly with the heavy-truck tyre domain:

Growth of logistics, e-commerce and last-mile delivery: As global logistics networks expand, commercial vehicle fleets increase in size and utilization, raising demand for reliable, high-quality tyres and accompanying support services. GlobeNewswire+1

Cost and efficiency pressures on fleet operators: Trucking companies increasingly view tyres not just as consumables, but as critical cost-elements — tyre life, downtime, fuel efficiency, maintenance frequency all feed into Total Cost of Ownership (TCO).

Higher safety/regulatory/quality expectations: With stricter safety regulations and higher standards for commercial vehicles, tyre performance (durability, load-rating, heat-resistance) becomes a differentiator.

Service and solutions orientation: Rather than simple tyre supply, fleets demand full-life-cycle services (selection, installation, monitoring, retreading) — aligning with the broader accessories trend of “bundled value” rather than pure product.

Heavy commercial vehicles (HCVs) growth: The report highlights HCVs as among the fastest-growing segments in the accessories space. GlobeNewswire

For a tyre provider, this means the landscape is changing: your offering must go beyond “we sell tyres” to “we optimise fleet tyre performance, reduce cost, ensure uptime”.

Given this market background, here are the strategic implications for our company and why truck fleets should choose us:

Positioning tyres as strategic assets

We emphasise that tyres are not just “wear items” but operational assets: their life, performance, downtime impact and replacement cost tie directly to fleet efficiency and profitability.Offer differentiated product + service bundle

High-performance profiles suited for heavy load, long haul, mixed terrain.

Reinforced carcass, high-heat endurance, strong casing suitable for demanding conditions.

Service support: selection matrix (matching truck type, route profile, load/cycle), installation support, monitoring of wear, retread or replacement planning.

This service-oriented model aligns with the accessories market trend of “value-added solutions”.Highlight total cost of ownership (TCO) benefits

We may charge a premium versus basic low-cost tyres, but when measured over life the cost per kilometre falls: fewer replacements, less downtime, better fuel efficiency, extended casing life. For fleets under cost pressure, this is a compelling argument.Leverage safety, reliability and brand reputation

With higher safety/regulatory scrutiny, selecting a trusted tyre supplier mitigates risk (accidents, blow-outs, downtime) and supports the fleet’s brand and operational continuity.Target growth segments smartly

Fleets operating heavy load, long haul, inter-regional routes are especially sensitive to tyre performance and lifecycle cost. These are prime targets for our reinforced, premium-service offering.

We advise truck fleet operators to adopt the following checklist when selecting tyre suppliers:

Ask for lifecycle data: expected mileage, number of retreads, performance in high-heat or heavy-haul conditions.

Match tyre specification to the actual route/load profile rather than defaulting to generic low-cost tyres.

Choose suppliers who offer monitoring and lifecycle services (e.g., wear analysis, rotation guidance, retread planning).

Evaluate tyres on cost-per-kilometre and downtime risk, not just upfront price.

Make safety, brand reputation and operational continuity part of the procurement decision.

In summary, the explosive growth projected in the commercial vehicle accessories market signals that suppliers of heavy-truck tyres are no longer just component vendors — they have the chance to become strategic partners helping fleets optimise cost, reliability and safety. By aligning our product-service bundle with the operational demands of modern fleets, we position ourselves for growth and differentiation in a rapidly evolving market. Fleet operators who recognise tyres as strategic investments — and select the right partner — will gain operational advantages. We invite you to explore how our high-performance truck tyres and lifecycle services can support your fleet’s uptime, cost-control and safety goals.

Copyright © 2024-2025 Firemax Sdn. Bhd Company. All rights reserved.

Headquarters address:303 block C, Pusat Dagangan Phileo Damansara 1, No 9 Jln 16/11 Off Jalan Damansara, 46350 Petaling Jaya, Selangor. Malaysia Sales Hotline:+60 11-6449 0688 After-sales hotline:+60 11-6449 0688