Lead (summary)

At the close of 2025, two timely developments point to where the global tyre industry is heading: Continental announced on 15 December 2025 that it has been re-elected as co-chair of the Tire Industry Project (TIP), and NEXEN released its plans on the same date to strengthen its market penetration through locally-customized products. These parallel moves—one reinforcing industry-level sustainability governance, the other prioritizing region-specific product adaptation—carry concrete implications for the truck & bus radial (TBR) market, including in Southeast Asia. Continental AG+1

Fact: Continental re-elected (factual)

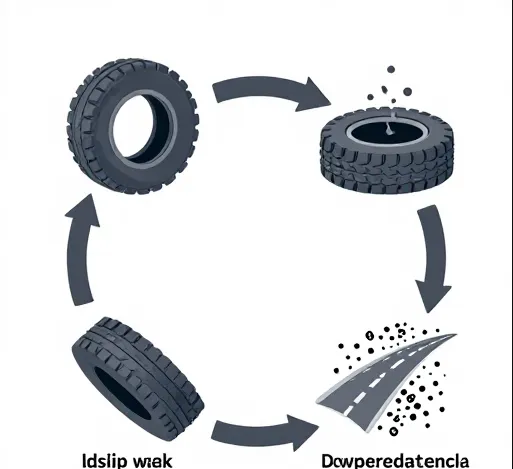

Continental’s official press release dated 15 December 2025 confirms the company’s re-election as co-chair of TIP through 2029. TIP is the tire industry’s principal forum focused on cross-company work on sustainability topics such as tyre and road wear particles (TRWP), end-of-life tyre management, and supply-chain transparency. Continental AG

Why Continental’s position matters (analysis)

Continental’s sustained leading role in TIP matters because it helps shape industry-level research priorities and standards—particularly around TRWP measurement techniques and KPIs. Influence at the TIP level can cascade into procurement standards, R&D focus on low rolling resistance and durable compounds, and joint projects addressing end-of-life tyre circularity. For truck tyre makers and fleet operators, this sets expectations that product lifecycles and environmental externalities will increasingly be measured and reported. Continental AG

Fact: NEXEN local customization strategy (factual)

Also on 15 December 2025, NEXEN published a release describing a push toward regionally customized products—tailoring tyre designs and compound formulations to local road conditions and fleet usage patterns, while strengthening local service networks to support fleets. The NewsMarket

Implications of NEXEN’s strategy (analysis)

NEXEN’s local-first approach addresses two market realities: fleets want tyres optimized for real-world operating conditions (reducing downtime and total cost of ownership), and manufacturers under trade/resilience pressures need to differentiate beyond price. For Southeast Asia, tailored tyre ranges could materially improve tyre longevity under tropical climates and heavy urban logistics patterns—resulting in lower per-kilometre costs for operators. The NewsMarket

Potential impact on local supply chains and jobs (analysis)

If major players raise sustainability criteria and pursue local adaptation, local suppliers—cord and bead makers, compounding houses, retread and recycling facilities—may see renewed demand for upgraded capabilities. This could translate to new investments and upskilling opportunities in Malaysia and neighboring countries, but it also necessitates investments in testing labs, certification (local standards bodies), and regulatory enforcement capacity. (This paragraph is interpretive analysis rather than a direct news quote.)

Safety and regulatory considerations (analysis / recommendation)

As the industry pushes both governance and localization, regulators should prioritize: (1) stronger market surveillance to prevent unsafe retreads or counterfeit tyres; (2) capacity building for TRWP and environmental monitoring so policies rest on empirical data; and (3) requirements for fleet tyre-monitoring solutions paired with vendor training to reduce accidents and hidden maintenance costs. These are actionable recommendations derived from the sector’s latest strategic signals.

Practical advice for fleets and distributors (tips)

For fleet managers and dealers: (a) evaluate total lifecycle cost (TCO) not unit price; (b) prioritize suppliers offering local service, traceable warranties, and data support; (c) insist on regional field-test evidence and retread compatibility data before converting a fleet. These steps align procurement with both operational resilience and emergent sustainability expectations.

Outlook (conclusion)

The December 2025 announcements are more than corporate PR—together they underscore two converging industry dynamics: standardized, collaborative approaches to sustainability at the industry level, and tactical regionalization of product portfolios by manufacturers. For stakeholders in Malaysia and Southeast Asia, this confluence offers opportunities to upgrade manufacturing, services, and regulatory practices. Watch for TIP work outputs and concrete product launches in 2026; those will be the market signals to act on. Continental AG+1

Copyright © 2024-2025 Firemax Sdn. Bhd Company. All rights reserved.

Headquarters address:303 block C, Pusat Dagangan Phileo Damansara 1, No 9 Jln 16/11 Off Jalan Damansara, 46350 Petaling Jaya, Selangor. Malaysia Sales Hotline:+60 11-6449 0688 After-sales hotline:+60 11-6449 0688