(December 31, 2025, Beijing Time) As the final page of the 2025 calendar is about to turn, the global commercial truck tire industry finds itself at a critical juncture filled with complex tensions and profound transformations. On one side, incessant safety alarms and increasingly severe trade barriers present a “frosty” test for the industry’s progress. On the other, the technological revolution fueled by electrification and the blazing ambition of corporate globalization paint a picture of fiery momentum.

A series of closely timed recent events—from emergency recalls by multinational giants and technological breakthroughs by Chinese leaders to the phase-based “pause” in EU trade investigations and the realignment of global production capacity—collectively sketch a vivid portrait of an industry advancing while being tempered amid “ice and fire.” This article aims to deeply analyze these year-end dynamics, dissect the underlying industrial logic, and contemplate the certainties and uncertainties ahead.

I. The Unshakable Foundation of Safety: Dual Warnings from Recent Accidents and Recalls

As the year closes, road traffic safety remains the “Sword of Damocles” hanging over the industry. Recent incidents both domestically and internationally once again reaffirm—directly and sharply—the absolute importance of tires as the lifeline of commercial vehicles.

Internationally, tire giant Bridgestone’s Firestone brand initiated a high-profile voluntary recall in the U.S. market in late December. According to filings with the National Highway Traffic Safety Administration (NHTSA), this recall involves 1,742 all-terrain LE3 series tires, with an estimated half (856) posing clear safety hazards. Produced in late October to early November 2025 in size 265/70R17, these tires were primarily for the light truck and SUV aftermarket. The root cause: a deviation in belt edge insert placement during manufacturing—directly compromising the structure, increasing the risk of belt separation, blowouts, loss of control, and even circumferential cracks due to component exposure.

Almost concurrently, a domestic traffic accident offered an even more visceral real-world reminder. On National Highway 205, a heavy tanker truck suffered a sudden tire blowout. The resulting shock wave not only destroyed the truck’s tire but also shattered the window and damaged the rear of the passenger car behind it. Police confirmed the blowout as the direct cause, with the truck driver fully liable. This case demonstrates vividly that a single defective truck tire can spill over into public safety risks.

Whether a proactive recall that prevents disaster, or a painful accident that already caused damage, both point to the same truth: robust tire inspection, maintenance, and replacement systems are not a cost burden—they are a core safety function protecting personnel, cargo, and society.

II. The Blaze of Technological Revolution: Electric-Driven Dedicated Tire Solutions Emerge

If safety is the industry’s bottom line, then technological innovation is the engine. In 2025, Chinese tire companies delivered breakthrough results in tires dedicated to electric commercial vehicles—directly targeting the industry’s transformation pain points.

With new energy commercial vehicle adoption accelerating globally, their dual characteristics—instant high torque and significant weight increase from battery packs—cause unprecedented “triple-high” challenges for traditional tires:

High wear

High failure rates

Irregular wear

To respond, Zhongce Rubber launched the “X Technology System”, a globally innovative integrated framework in materials, structure, and process:

Technology Purpose X-Carbon Extreme Technology +50% wear resistance, reduce irregular wear & bead failures X-Mystic Armor Technology Reinforce bead & carcass strength for high-load EV applications X-Craftsmanship Technology New vulcanization improving rubber density & heat/wear performance Based on this system, Zhongce released full application dedicated electric-truck tire families adapted to major new-energy commercial vehicle OEMs. Its significance: China’s tire industry is shifting from “following and adapting” to “leading and defining”—turning tires from a cost item into a value-enhancing component improving range, safety, and efficiency.

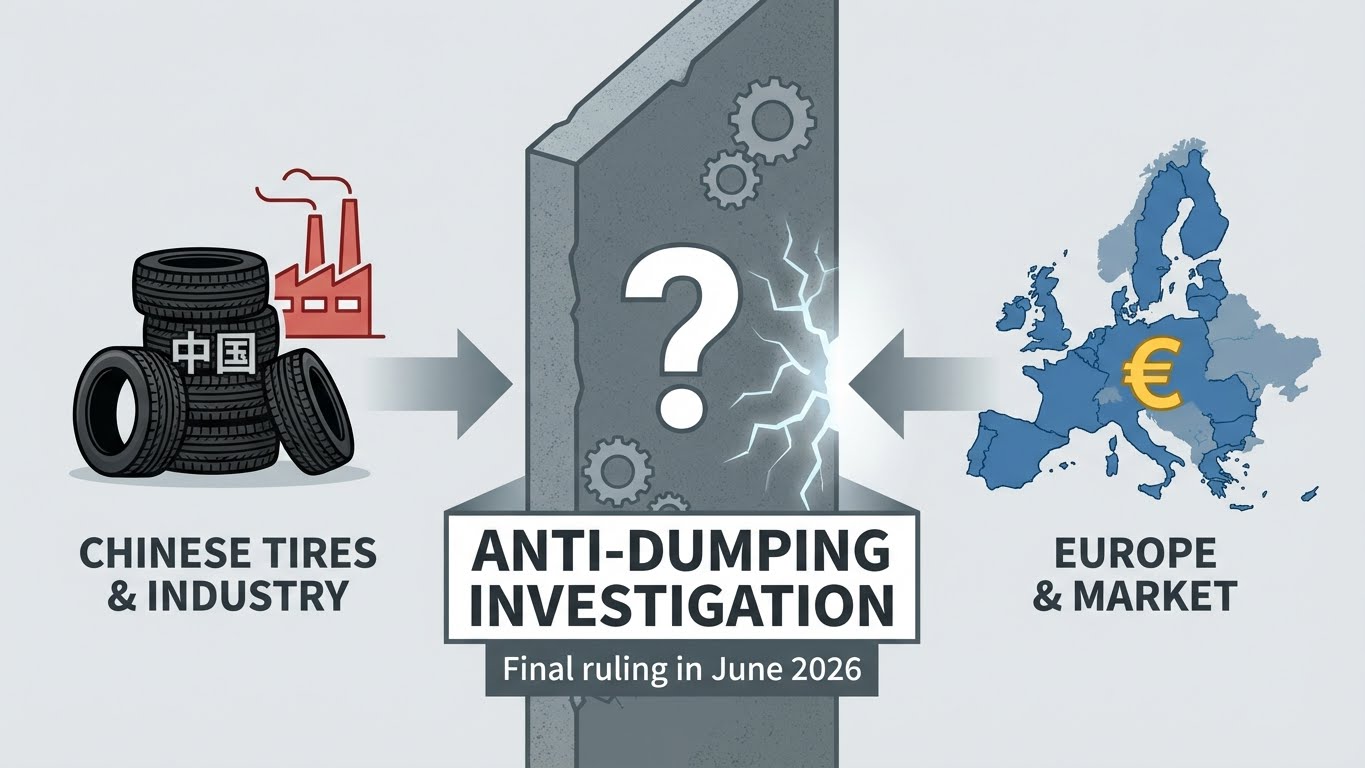

III. The “Frozen” Trade Environment: Pending EU Dual Anti Investigations Place Pressure on Exports

The fire of innovation cannot fully dispel the chill of trade protectionism. In 2025, Chinese tire exporters faced some of their most complex challenges yet.

The EU’s anti-dumping investigation launched in May reached a phase milestone on December 18: the European Commission decided not to impose provisional duties—citing “technical complexity.” But this does not mean risk is eliminated:

Final anti-dumping ruling due June 2026

Duty rate highly uncertain

Countervailing (anti-subsidy) investigation added in November → overlapping “dual anti”

Retroactive duty risk up to 90 days before final ruling still exists

Exports to Europe already show pressure: analysts note slower growth Jan–Oct 2025 and possible front-loaded demand due to early stockpiling. Meanwhile, the U.S. imposed an additional 25% “reciprocal tariff” on Chinese tires and auto parts in May.

Result: Traditional high-end markets—North America and Europe—now face historic levels of trade barriers.

This pressure is fundamentally accelerating a shift in strategy—from simple product export to global production capacity deployment.

IV. “Breaking the Ice” Through Global Deployment: Overseas Expansion Builds New Resilience

Facing frozen trade barriers, Chinese tire companies are counterattacking through global investments and acquisitions, weaving a new resilient international supply network. 2025 became a pivotal acceleration year.

Examples:

Event Strategic Significance Linglong Tire — Brazil factory, 8.7B RMB First Chinese production base in South America Haian Group — Russia giant OTR factory, 4B+ RMB Anchoring emerging markets Huafeng Rubber — Acquired Sumitomo factory in New York Localized U.S. production breakthrough Hankook — Tennessee Phase II trial operations Boosting North American supply resilience Zhongce Rubber — A-share main-board listing Major capital boost Sailun Group — Acquired Bridgestone Shenyang plant Domestic capacity optimization A “produce where you sell” model is becoming a mainstream strategic response to protectionism.

Conclusion: Forging the Future in the Game

Looking back at the end of 2025, the commercial truck tire industry is a narrative of dialectical coexistence:

The “Ice” The “Fire” Safety incidents Electrification-driven innovation Trade barriers Global capacity deployment Structural uncertainty Strategy and technology maturity Future competition requires dual excellence:

Hard power: materials, structure, digitization, EV-adapted tire performance

Soft power: capital allocation, global supply chain, risk management

For logistics operators and fleets, optimizing safety, technology compatibility, and life-cycle cost will be paramount. Only by respecting safety, embracing innovation, and maintaining a global vision can the industry’s wheels—tempered through ice and fire—roll steadily toward a more efficient and sustainable future.

Copyright © 2024-2025 Firemax Sdn. Bhd Company. All rights reserved.

Headquarters address:303 block C, Pusat Dagangan Phileo Damansara 1, No 9 Jln 16/11 Off Jalan Damansara, 46350 Petaling Jaya, Selangor. Malaysia Sales Hotline:+60 11-6449 0688 After-sales hotline:+60 11-6449 0688